Opendoor’s Q2 Earnings Preview: What to Expect

As we approach the release of Opendoor’s Q2 earnings report, there are several key factors that stakeholders and industry analysts will be keenly watching. Opendoor, a leading digital platform for residential real estate, has been navigating a rapidly evolving market environment, influenced by significant shifts in housing trends and economic conditions due to the global pandemic.

The report is expected to provide insights into the company’s performance amidst these changes, with particular interest in metrics like revenue growth, net income, and operating margins. Moreover, observers will be looking at the company’s customer acquisition rates and average selling prices, which are crucial indicators of its competitive position and market share. Also, any forward-looking statements or guidance from the company, particularly regarding its outlook for the rest of the fiscal year, will be of significant interest.

It will be important to see how Opendoor’s strategic initiatives and investments, such as its expansion into new markets and enhancement of its digital capabilities, are translating into financial results. All eyes will also be on the company’s operating expenses and cash flow position, as these will shed light on its financial health and ability to sustain growth. In a nutshell, the Q2 earnings preview is anticipated to reveal a comprehensive picture of Opendoor’s performance, strategic direction, and future prospects.

Analyzing Opendoor’s Financial Performance

Opendoor’s financial performance can be assessed by examining various indicators such as revenue growth, net income, operating expenses, and liquidity position. In recent years, Opendoor has witnessed a significant increase in revenue, indicating a growing customer base and successful marketing strategies. However, this growth has been accompanied by a steep rise in operating expenses, absorbing a substantial part of the revenue generated.

The company’s net income, a crucial measure of profitability, has remained negative, suggesting that Opendoor has yet to reach a break-even point. Furthermore, Opendoor’s liquidity position, as indicated by its current ratio and quick ratio, raises concerns about its ability to cover short-term liabilities. While the company has managed to secure significant funding from investors, it is essential that it implements strategies to control operating expenses and move towards profitability.

An in-depth analysis of its financial statements, including the income statement, balance sheet, and cash flow statement, can provide further insights into Opendoor’s financial performance and its potential to generate sustainable profits in the future. Despite these challenges, Opendoor’s pioneering role in the online real estate market, coupled with its innovative business model, may provide it with the necessary leverage to overcome its financial hurdles and achieve long-term financial stability.

Key Factors Impacting Q2 Earnings

The second quarter (Q2) earnings of a company are typically influenced by a variety of key factors. One of the most significant ones is the economic environment during the specific quarter. Any changes in GDP, inflation rates, unemployment rates, and consumer confidence can have a considerable impact on a company’s earnings. These macroeconomic indicators affect consumer spending, which in turn influences the revenue of businesses.

Another important factor is the business strategy of the company. This includes the company’s operational efficiency, cost management, and marketing initiatives. If a company is able to manage its costs effectively and increase its operational efficiency, it can significantly boost its Q2 earnings. On the other hand, ineffective cost management and low operational efficiency can lead to reduced earnings.

Market competition is another factor that can impact Q2 earnings. Companies operating in highly competitive markets may face pressure on their profit margins, which can affect their earnings. On the other hand, companies with a strong competitive advantage can maintain or even increase their earnings despite the competitive pressure.

Technological advancements can also have a significant impact on a company’s Q2 earnings. Companies that are able to leverage new technologies to improve their products or services, increase their operational efficiency, or reach new customers can see a positive impact on their earnings. However, companies that fail to adapt to technological changes may see a negative impact on their earnings.

Finally, geopolitical events and changes in regulatory environment can also affect Q2 earnings. Events like trade wars, political instability, or changes in government policies can create uncertainty in the market, which can negatively affect a company’s earnings. Conversely, positive geopolitical events or favorable changes in regulations can boost a company’s earnings.

In conclusion, the Q2 earnings of a company are influenced by a variety of factors, including the economic environment, business strategy, market competition, technological advancements, and geopolitical events. Companies need to monitor these factors closely and adapt their strategies accordingly to maximize their earnings.

Market Expectations for Opendoor

Market expectations for Opendoor, a pioneering real estate platform, are high due to its innovative approach to buying and selling homes. The company’s unique business model, which allows homeowners to sell their homes quickly and directly to Opendoor, has created a stir in the marketplace. Investors and industry professionals are closely monitoring the company’s performance, given its potential to disrupt the traditional real estate market.

The company’s initial public offering (IPO) in late 2020 was a significant milestone which further increased market expectations. Opendoor’s technology-driven platform offers a seamless user experience that eliminates many of the pain points associated with traditional home selling, such as staging, showings, and negotiation. This has given the company a competitive edge and has led industry analysts to predict strong growth in the years ahead. However, Opendoor operates in a highly cyclical industry that is sensitive to economic conditions and interest rates, factors that could impact the company’s growth trajectory.

Furthermore, the company faces stiff competition from other tech-enabled real estate platforms. Despite these challenges, many believe that Opendoor is well-positioned to capitalize on the shift towards digitization in the real estate industry. The company’s ability to scale and innovate, along with its commitment to customer satisfaction, are seen as key strengths that could propel its success in the coming years. As Opendoor continues its journey, the market will be eagerly watching for signs of its sustained growth and profitability.

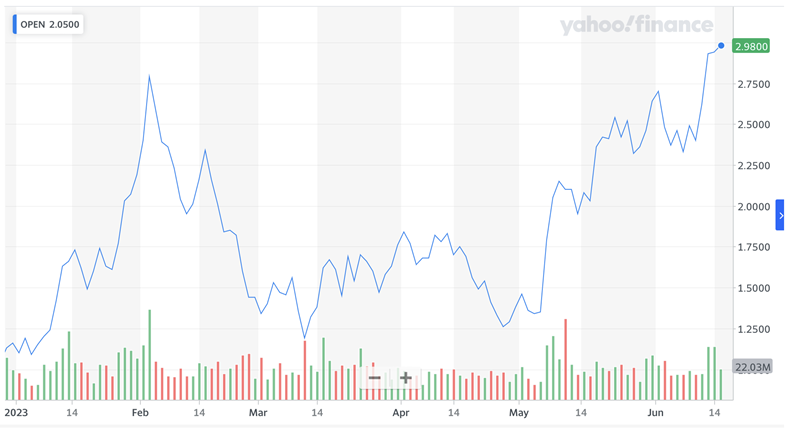

How Opendoor’s Q2 Results Could Affect Its Stock

Opendoor’s second quarter financial results could significantly influence the trajectory of its stock price. If the company reports strong earnings and revenue growth, it could potentially instigate a positive reaction from the market, propelling the stock’s value upward. Conversely, a weak performance could lead to a decline in stock price. Investors closely scrutinize these quarterly results as they provide insights into the company’s operational efficiency, financial health and strategic direction.

Additionally, the outlook provided by the company for future growth and earnings also plays a crucial role in shaping investor sentiment and impacting stock value. The real estate market has undergone substantial shifts due to the global pandemic, and Opendoor’s ability to navigate these changes successfully could be a key factor in its Q2 results. Given the company’s focus on digital transformation in the real estate sector, positive advancements in this area could also contribute to a favorable market reaction.

However, concerns about inflated housing prices and potential market volatility might affect investor confidence and in turn, the stock price. Opendoor’s Q2 results would not only reflect its past performance but also set the tone for future expectations. Hence, it is important for potential investors and current shareholders to understand the implications of these results on the company’s stock price.

Expert Predictions on Opendoor’s Future

Experts have varying predictions regarding the future trajectory of Opendoor, a leading digital platform for buying and selling real estate. Some analysts foresee immense growth and success for the company, given its innovative model that simplifies the traditionally convoluted real estate process. They believe that as technology advances and consumer behaviors shift towards more digital solutions, Opendoor’s model of instant buying and selling of homes will become increasingly popular. Furthermore, the ongoing trend of remote work and flexible living arrangements may also fuel the demand for Opendoor’s services.

On the other hand, some experts express concerns about the company’s profitability due to the highly competitive and capital-intensive nature of the real estate industry. They argue that while Opendoor’s business model is groundbreaking, it also carries substantial risks. Market volatility, for instance, could lead to significant losses if the company fails to sell its properties at a profit.

There is also a debate about the sustainability of Opendoor’s growth. While its digital-first approach has been a key driver of its expansion, some experts question whether it can maintain this momentum as more competitors enter the space. Other industry players like Zillow and Redfin are already offering similar services, which could potentially limit Opendoor’s market share.

In summary, expert predictions on Opendoor’s future are mixed. While its innovative business model and the shift towards digital solutions in real estate present significant opportunities, the risks associated with market volatility, competition, and the capital-intensive nature of the industry remain. It remains to be seen how Opendoor navigates these challenges and capitalizes on its opportunities in the coming years.